Costello College of Business News

- April 19, 2024Led by the Center for Innovation and Entrepreneurship (CIE) within the Costello College of Business at George Mason University, the Patriot Pitch Competition supports early-stage business ventures and ideas from Mason students and recent alumni. On April 11, the finalists made their final pitches on the Fairfax Campus.

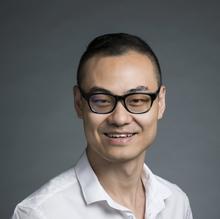

- April 18, 2024Bo Hu, an assistant professor of finance at Mason, is developing new research methods to better capture the intricate, interlinked dynamics of financial markets.

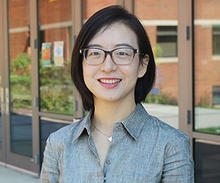

- April 16, 2024Like financial markets, the creative industries are driven to seek equilibrium, which may be good news for both human content creators and their algorithmic adversaries. Jiasun Li, an associate professor of finance, is researching this in a new working paper.

- April 15, 2024To mark the beginning of a broader academic connect between George Mason and leading universities in Viet Nam, the Costello College of Business and University Libraries officially opened a special exhibition in partnership with the Embassy of the Socialist Republic of Viet Nam and received their donation of rare books to the university's special collections.

- April 11, 2024The students’ trip to the headquarters showed them how they could apply what they have learned in the classrooms as future professionals, whether it be at the SEC or elsewhere.

- April 10, 2024Measuring risk in private equity is notoriously difficult. New research by Mason assistant professor of accounting, Mariia Nykyforovych, suggests that metric-based myopia, and the distorted incentives it creates, are partly responsible.

- April 5, 2024You can spend millions to buy a company for its employees, but how do you know they’ll stay put? Now, AI can predict post-deal turnover with a startling degree of accuracy. In a recently working paper, Jingyuan Yang, an information systems and operations management professor at the Costello College of Business at George Mason University, discovers how to efficiently predict employee turnover using an innovative AI-driven approach

- April 3, 2024Mason accounting professor, David Koo, goes back through history to trace how financial reporting requirements affect investors’ long- vs. short-term thinking.

- April 3, 2024New EduRank report on university performance in research highlights eighteen George Mason University programs as the best in Virginia, with Mason's entrepreneurship ecosystem as No.1 among all public institutions.

- March 28, 2024The college that now bears Donald G. Costello’s name is a fitting testament to his entrepreneurial legacy. This extends not only to coursework and outreach programs, which have long stressed entrepreneurship, but also to the faculty’s research expertise. Indeed, a number of Costello College of Business professors were key contributors to Mason’s being named the #2 university for entrepreneurship research in North America by independent ratings agency EduRank.

- March 27, 2024On the morning of Friday, March 1, Christine Landoll, director of business engagement at the Costello College of Business, welcomed guests to the Forensic Science Research and Training Laboratory, or “body farm,” on George Mason University’s Science and Technology Campus in Prince William County.

- March 21, 2024Co-founded in 2018 by Trevor Montano, BS Accounting ’00, and Derek Horstmeyer, a professor of finance at the Costello College of Business at George Mason University, the Montano Student Investment Fund (SMIF) is an all-equity investment fund administered by finance students at the Costello College of Business.